10 Simple Techniques For Unicorn Finance Services

Table of ContentsNot known Details About Unicorn Finance Services Some Ideas on Unicorn Finance Services You Need To KnowUnicorn Finance Services Can Be Fun For EveryoneThe Definitive Guide for Unicorn Finance ServicesEverything about Unicorn Finance Services

What are the benefits of utilizing a home loan broker? The number one reason why you ought to make use of a home loan broker is because we have your ideal rate of interests at heart and also will aid you discover the best product for you.

The crowning achievement is that we do not charge anything for our services the lenders pay us a commission. The payment amount is regarding the same throughout all loan providers as well as home finance products, so you can rest guaranteed we are not biased in the direction of one supplier. To learn even more about how we can help you, or to talk with us concerning your financing and home mortgage choices, please call us today.

Some Of Unicorn Finance Services

Your broker will certainly after that utilize a specialized mortgage calculator to figure out which of our 30 lending institutions can provide the very best home mortgage bargain for you. Right here's where you get to be a part of the decision-making process with each other with your home loan expert, you'll choose the right mortgage to match your demands currently.

Oh, and also don't wait to ask your home loan specialist anything regarding the whole procedure. With a vast array of know-how concerning loan-related issues as well as substantial (as well as sensible) experience, our brokers are right here to assist you out to the finest of their abilities (https://community.mozilla.org/en/events/unicorn-finance-services/?success=1).

As a Money Broker, we do not help the banks we benefit you. Presently, there is a large range of home mortgage products on the market which indicates that your suitable financing item is available for you, it just takes a great deal of research study to find the one that suits your situation perfectly.

The Single Strategy To Use For Unicorn Finance Services

Locate a Mortgage Broker, Mortgage Technique, Property Investment Today, numerous Australians choose to utilize a home loan broker to organize their home mortgage. There are still quite a couple of that had actually instead stroll down to the bank directly to prepare their home loan. For financiers, taking the DIY course could not be really useful in the long run.

As the number of buildings under your belt expands, it may not be as very easy for you to borrow money as it was the first time. Hitting the use wall surface is the biggest obstacle building financiers face as they try to broaden their profile. Which's where an experienced mortgage broker can can be found in helpful.

For example, does the lending institution consist of the rental from the brand-new residential property right into your earnings? If indeed, what percentage of the rental is consisted of? What is the analysis rate at which they calculate your utility? All these variables will certainly determine just how much you can obtain for successive homes. As an investor, it is not possible for you to understand the eligibility criteria used by various financial institutions while assessing your instance.

The Best Guide To Unicorn Finance Services

As an example, some brokers may deal extensively with first house buyers, some could specialise in negative credit fundings while a few other might have unrivaled expertise in the field of financial investment borrowing (Home loan broker Melbourne). As a financier, it is very important that you discover yourself an expert financial investment mortgage broker that is abreast of the growths in the sector (https://www.intensedebate.com/profiles/unicornfinan1).

To begin, post your inquiry online or fill up this get in touch with kind so that we can put a home mortgage broker in touch with you. By Vidhu Bajaj, Hash, Ching Material Writer Locate a Home Loan Broker, Mortgage Method, Residential or commercial property Financial Visit Your URL investment.

The smart Trick of Unicorn Finance Services That Nobody is Discussing

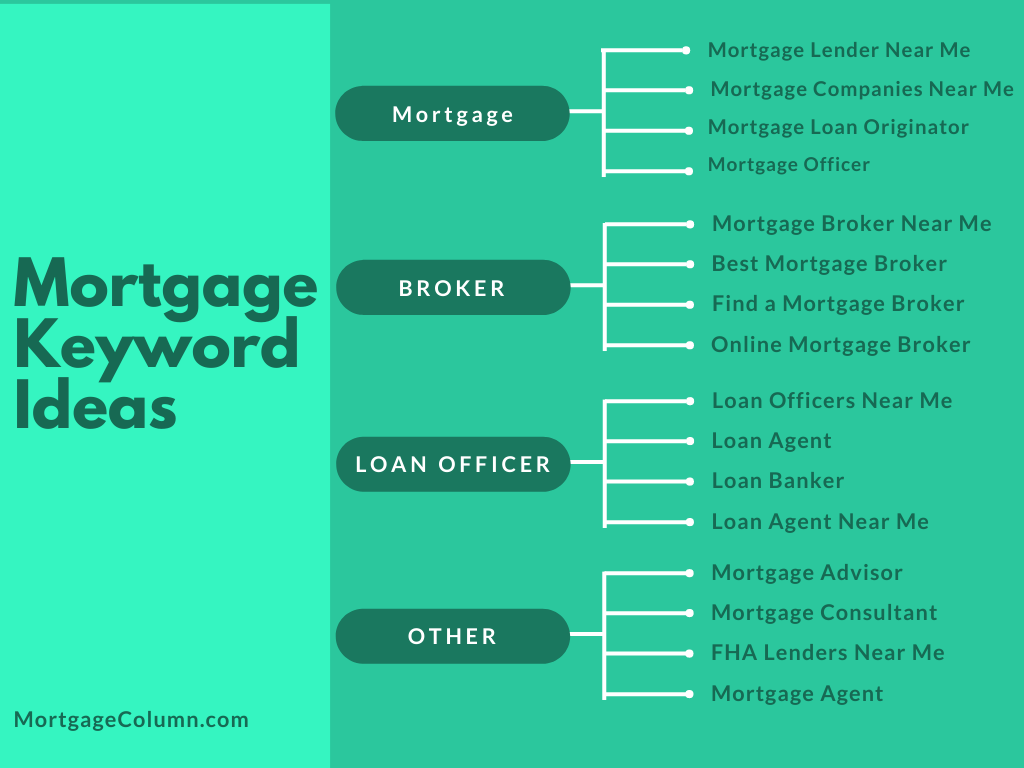

So, you're trying to find home mortgage deals to assist you buy a building, but with numerous mortgage companies and mortgage lending institutions out there, it can be tough to understand where to start - Mortgage brokers Melbourne. Or, probably you feel it's great to do without a home mortgage broker due to the fact that you're concentrated on attempting to save money.

Because what may appear like cheap home loans to you may not in fact be that competitive when every charge as well as problem is taken into consideration. By taking your scenarios right into consideration, a home loan broker advantages consist of showing you the mortgage deals that you have an excellent possibility of being authorized for by home mortgage loan providers.